- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

How to Register for GST

image from e-startup rajasthan

Who wants to Register under GST?

Under the Goods and Service Tax Act 2017, It is clearly specified annual turnover limit for goods business and service providers. For Goods seals and purchase limit is ₹40 lakh and the limit for Service providers is ₹20 lakh. Any kind of business Goods or Service if it crosses the annual turnover limit which is given by the government under GST Act 2017, then it might be applying for GST Registration.

Documents Required for GST Registration- PAN Card of the applicant

- Aadhar Card of the applicant

- Address proof of your office

- Incorporation certificate

- Proprietor's ID proof

- Bank Statement of the applicant and also cancelled cheque

- Letter of authorisation with the authorised signatory.

GST Registration Process Step by Step

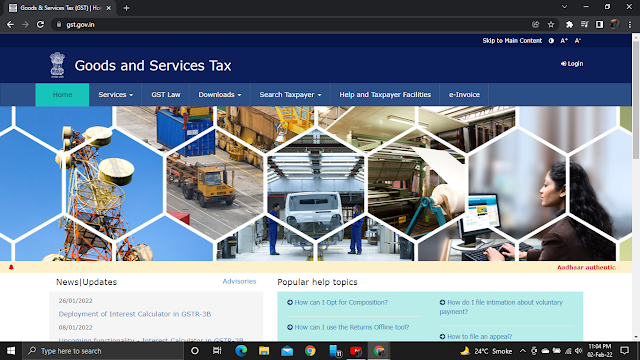

In a way to apply for New GST Registration, the applier has to file Form GST REGISTRATION-01 in two parts Part - A and Part - B. (source of the image is GST website: www.gst.gov.in/) The following steps will easily help for online registration process for GST-

Form Part A of GST REG-01Step 1: Visit the official website of GST. Click here 👉GST👈

Otherwise, go to go home page Taxpayer section and Select "Register Now"

Step 3: Select the "New Registration" then fill-up the required information

- In this step you have to select an 'I am a Taxpayer' from the selection list.

- Select your state and district.

- Provide the legal name of the business and PAN.

- Add an active email ID and mobile number, as an OTP will be sent to these channels.

Step 4: After verifying your e-mail id and mobile number, a Temporary Reference Number (TRN) will be generated and it also send to your registered e-mail id and mobile number. It's a special 15 - digits reference number that needs to go further to till the part B of GST REG-01. It's valid up to 15 days from the date of generation.

Form Part B of GST REG-01

Step 5: To complete the remaining application of GST Registration we have to log in on the GST website. Service > Registration > Temporary Registration Number (TRN).

Step 6: here Temporary Registration Number (TRN) is used as login id and type captcha. Then OTP will generate a registered e-mail or mobile number, type OTP and you will redirect us on your dashboard on your saved application and then click to the 'Edit' button which is given on the right side of your application.

Step 7: After clicking on the 'Edit' button you are redirected to Part B of GST REG-01

Step 8: Fill in all the information which is required in 10 Major sections, It is mandatory to fill all 10 sections. In this section, we have to fill up our Business Details, Proprietor's Details, Principal Place of Business, Goods and Services Code, Bank Details, etc.

Step 9: In the last section of the above 10 sections we have to verify the application for verifying application check the declaration and submit the application of any three following options:- Submit with EVC(Electronic Verification Code) - An OTP will send to the registered e-mail id and mobile number,

- Submit with Digital Signature and - This method is crucial for Companies, Partnership firms, LLP firms, etc.

- E-sign method - An OTP will send to the registered e-mail id and mobile number.

Step 10: After successful completion of the above-mentioned steps an Application Reference Number (ARN) receipt will send on registered e-mail id and mobile number. With help of this ARN number, you can check the status of your application on the GST Portal.

- PAN Card of the applicant

- Aadhar Card of the applicant

- Address proof of your office

- Incorporation certificate

- Proprietor's ID proof

- Bank Statement of the applicant and also cancelled cheque

- Letter of authorisation with the authorised signatory.

GST Registration Process Step by Step

In a way to apply for New GST Registration, the applier has to file Form GST REGISTRATION-01 in two parts Part - A and Part - B. (source of the image is GST website: www.gst.gov.in/)

The following steps will easily help for online registration process for GST-

Form Part A of GST REG-01

Step 1: Visit the official website of GST. Click here 👉GST👈

Otherwise, go to go home page Taxpayer section and Select "Register Now"

Step 3: Select the "New Registration" then fill-up the required information

- In this step you have to select an 'I am a Taxpayer' from the selection list.

- Select your state and district.

- Provide the legal name of the business and PAN.

- Add an active email ID and mobile number, as an OTP will be sent to these channels.

Step 4: After verifying your e-mail id and mobile number, a Temporary Reference Number (TRN) will be generated and it also send to your registered e-mail id and mobile number. It's a special 15 - digits reference number that needs to go further to till the part B of GST REG-01. It's valid up to 15 days from the date of generation.

Form Part B of GST REG-01

Step 5: To complete the remaining application of GST Registration we have to log in on the GST website.

Service > Registration > Temporary Registration Number (TRN).

Step 6: here Temporary Registration Number (TRN) is used as login id and type captcha. Then OTP will generate a registered e-mail or mobile number, type OTP and you will redirect us on your dashboard on your saved application and then click to the 'Edit' button which is given on the right side of your application.

Step 7: After clicking on the 'Edit' button you are redirected to Part B of GST REG-01

Step 8: Fill in all the information which is required in 10 Major sections, It is mandatory to fill all 10 sections.

In this section, we have to fill up our Business Details, Proprietor's Details, Principal Place of Business, Goods and Services Code, Bank Details, etc.

Step 9: In the last section of the above 10 sections we have to verify the application for verifying application check the declaration and submit the application of any three following options:

- Submit with EVC(Electronic Verification Code) - An OTP will send to the registered e-mail id and mobile number,

- Submit with Digital Signature and - This method is crucial for Companies, Partnership firms, LLP firms, etc.

- E-sign method - An OTP will send to the registered e-mail id and mobile number.

With help of this ARN number, you can check the status of your application on the GST Portal.

- Get link

- X

- Other Apps

Comments

Post a Comment