- Get link

- X

- Other Apps

- Get link

- X

- Other Apps

What is GSTR-2B?

Hi friends, In the above topic we see how we know the data is given in GSTR-2A. In this topic, we are discussing GSTR-2B? Which points are included in GSTR-2B? How GSTR-2B is helpful to accountants to file particular client's GSTR-3B? and also discuss other topics related to GSTR-2B.

When we click on GSTR-2B first we see the details of the GSTIN holder like its GST Number, Legal Name of Business, Trade Name, Financial Year, and Return Period. GSTR-2B is an automatically generated report. It is generated on the 14th of the month after filing the GSTR-1 of every month. Then we see the details of GSTR-2B where it is provided in 2 different types first one is in "Summary" and the second one is "All Table" where the details are provided with different tables heads as follows.

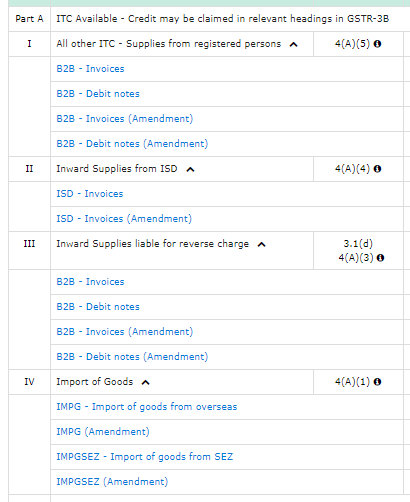

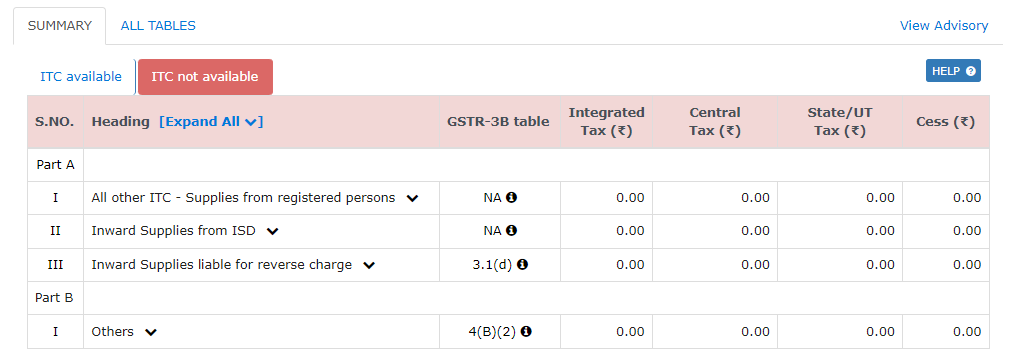

In the first option of summary, we can see also 2 parts in which the first one is ITC available and the second one is ITC not available. The main details are provided in the first option of ITC available the details are provided is in two parts of ITC one of these parts, Part-A is provided ITC collected in the current period, and Part-B it is provided ITC Reversal which means that types of ITC which are we taken wrongly and it's also included ITC of Credit/Debit Note. There is also another table that denotes the effect of a particular ITC in the form of GSTR-3B.

- All other ITC - Supplies from registered person,

- Inward Supplies from ISD,

- Inward Supplies liable for reverse charge,

- Import of Goods.

The above show points include B2B - Invoices, B2B - Debit notes, B2B - Invoices (Amendment), and B2B - Debit notes (Amendment). ISD - Invoice and ISD - Invoice (Amendment) are included in the second point and the last point includes the IMPG which means Import of Goods overseas and its Amendment Invoices and IMPGSEZ which means Import of Goods from SEZ and its Amendment.

As well as we can see in the Part-B of GSTR-2A we only include B2B Credit Notes, B2B Credit Notes (Reverse charge), ISD - Credit Note and its Amendment invoices.

In the part of ITC, the not available portal shows the types of an invoice that ITC we can't take in particular months.

Now we will see the second option of GSTR-2A which is denoted by "ALL TABLES". As we discussed above that in this option we can see details table-wise. Here also given 2 option in which the first option is to provide us "Supplier wise Details" and the other option is to provide "Document Details" and both images are provided as follow:

1.) Supplier wise Details:

In this option, we get all the details that are Supplier wise like the Supplier's GST Number and its Trade Name, Number of Invoices, Taxable Value of invoices, and its different columns of taxes which is IGST, CGST, SGST, and Cess and the period of invoice and GSTR-1 and GSTR-5.

- Get link

- X

- Other Apps

.png)

Comments

Post a Comment